Spending is budgeted to barely increase in the Rural Municipality of Wallace-Woodworth, yet many property owners will see an increase in their taxes.

The RM of Wallace-Woodworth presented their 2018 budget to the public on May 7, in Council Chambers.

“Council’s challenge to administration this year was to try and go somewhere between zero increase and one per cent in spending. We’re at a .28 per cent increase...” stated Garth Mitchell, Chief Administrative Officer for the RM of Wallace-Woodworth.

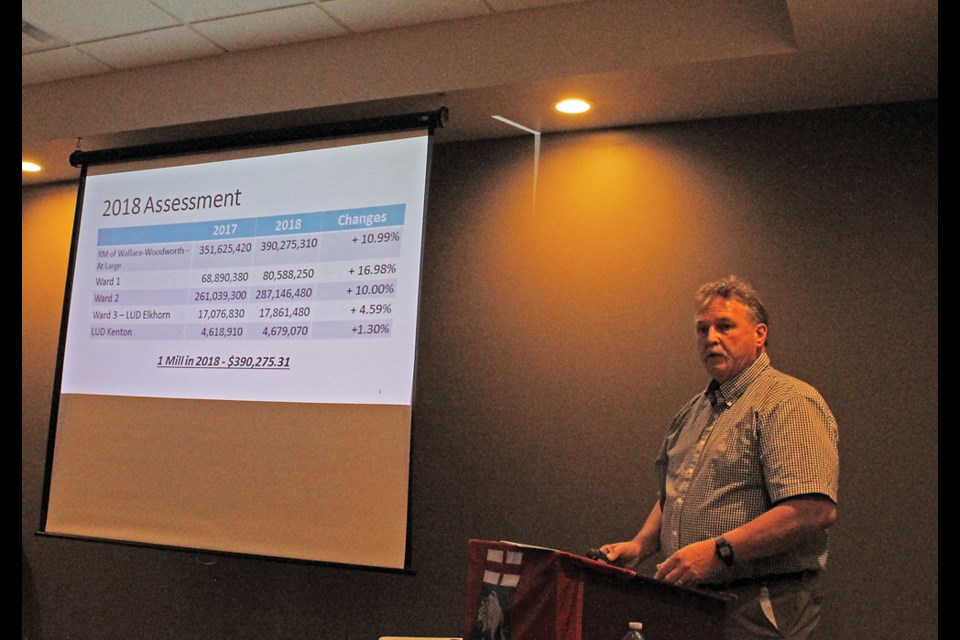

It is property assessment that is hurting many ratepayers. Assessments are done every two years now and all Wards saw an increase in their assessed values.

Farm land hit hard

“The big one to bring to your attention, which you are probably aware of if you have farm land, is the farm land assessment. An increase of 41.8 per cent in the land assessment, which is a huge increase, reflective of the sales in the past two years,” said Mitchell.

He pointed out that assessments are appealable to the Assessment Branch, but with farm land prices continuing to be high, assessments are expected to continue at this level.

Hospitals and schools also have a huge increase in their assessed value – a 57.3 per cent increase, but that has little effect on the rural municipality.

Commercial and Industrial property decreased by 3.3 per cent; recreational property is down 1.8 per cent; single family residential was also down slightly, minimally affecting the rural municipality.

Mill rate down

With the At Large assessment up by 10.99 per cent and nearly 17 per cent higher in Ward 1 (former Woodworth), the mill rate was lowered throughout the municipality by about one per cent, to 14.758 and consistently applied throughout the RM.

Mitchell explained the impact of the changes in the assessment.

“If you had an overall increase of 9.3 per cent or less, you are going to see a decrease in your taxes.” Where assessments rose by more than 9.3 per cent, taxes go up.

Spending

Two per cent of spending goes to pay elected councillors indemnities and to send them to meetings.

To maintain transportation services (roads) the RM expects to spend about $4.377 million, or about 39 per cent of spending.

Nearly one quarter of taxes levied goes directly for education.

Numerous reserve funds for special projects total in excess of $1.778 million.

All of council was present for the hearing; a few office staff and three ratepayers attended, along with media.

The water utility, which is running a deficit in several places, was an item questioned by rate payers.

No objections to the budget were raised.

In a Special Meeting following the hearing, and in the following day’s Regular Council Meeting, council voted to pass the $11.3 million budget.